Man tied to Lebanon school lockdowns pleads not guilty to charges

LEBANON — A Vershire man has pleaded not guilty to criminal charges stemming from an incident that provoked a lockdown at Lebanon High School and Hanover Street School in March when he allegedly approached the school campus with loaded weapons in his...

New Mascoma equestrian team has early success

WEST CANAAN — The group might be small with only four athletes, but so far the success of Mascoma Valley Regional High School’s newest team has been large.The newly formed Mascoma equestrian team — Molly Gray, Aubrey Meyveagaci, Abby Waugh and Rainah...

Most Read

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom

Herd departs Hartford’s last remaining dairy farm

Herd departs Hartford’s last remaining dairy farm

Lebanon moves forward with plans for employee housing

Lebanon moves forward with plans for employee housing

Colby-Sawyer president announces plan to depart

Colby-Sawyer president announces plan to depart

Windsor man who failed to show up for trial arrested in Hartland

Windsor man who failed to show up for trial arrested in Hartland

Editors Picks

Herd departs Hartford’s last remaining dairy farm

Herd departs Hartford’s last remaining dairy farm

A Life: Richard Fabrizio ‘was not getting rich but was doing something that made him happy’

A Life: Richard Fabrizio ‘was not getting rich but was doing something that made him happy’

Kenyon: What makes Dartmouth different?

Kenyon: What makes Dartmouth different?

Publisher’s note: Valley News launches updated online app

Publisher’s note: Valley News launches updated online app

Sports

Local Roundup: Lebanon wins big over Bow in boys tennis

Editor’s note: To have your team’s results included in the Local Roundup, visit https://www.vnews.com/submit-a-score.Boys Tennis Lebanon 8, Bow 1 Key players: Lebanon — Nolan Arado, Will Katz Highlights: It was Senior Night, and the seniors held...

Lebanon has chances but still can’t solve Hanover baseball mystery

Lebanon has chances but still can’t solve Hanover baseball mystery

Volunteers work to repair Upper Valley trails damaged by storms

Volunteers work to repair Upper Valley trails damaged by storms

Local Roundup: Hanover hangs on for 11-9 softball win over Lebanon

Local Roundup: Hanover hangs on for 11-9 softball win over Lebanon

Opinion

Editorial: Chris Sununu’s moral vacuum

New Hampshire Gov. Chris Sununu’s conversion from “Never Trump” to “Ever Trump” occurred not on the road to Damascus but on the Republican Party’s road to perdition.On ABC News last Sunday, Sununu affirmed his intention to support Donald Trump for...

Editorial: Gambling tarnishes America’s sporting life

Editorial: Gambling tarnishes America’s sporting life

By the Way: A white nationalist’s many mistruths

By the Way: A white nationalist’s many mistruths

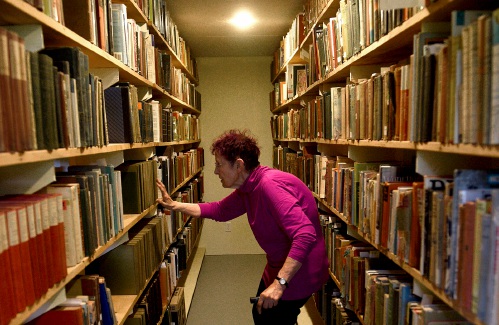

Column: The age-old question of what to read

Column: The age-old question of what to read

Editorial: Transparency wins in NH Supreme Court ruling

Editorial: Transparency wins in NH Supreme Court ruling

Photos

Spring cleanup in Lebanon

Drawn to dragons

Drawn to dragons

Clear and free in Hartford

Clear and free in Hartford

Ramping up their foraging

Ramping up their foraging

Roadside assist in Bethel

Roadside assist in Bethel

Arts & Life

Bald eagles are back, but great blue herons paid the price

After years of absence, the most patriotic bird in the sky returned to Vermont — but it might’ve come at another’s expense.Vermont finally took the bald eagle off of its endangered species list in 2022 following years of reintroduction efforts...

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

How a hurricane and a cardinal launched a UVM professor on a new career path

How a hurricane and a cardinal launched a UVM professor on a new career path

Obituaries

Kevin Currier

Kevin Currier

Topsham, VT - Kevin Charles Currier died unexpectedly at his home in Topsham, VT on April 13, 2024 at the age of 62. Our beloved Cubby, Bub or Bubby, as he was fondly called by his family and friends, was born on May 22, 1961 to Charle... remainder of obit for Kevin Currier

Ann Young

Ann Young

Rye, NH - Ann Eastman Young was born in Hanover, New Hampshire, in the wee hours of April 21, 1958. She remained a morning person for the rest of her life, embracing sunrises from New Hampshire to Florida, California and beyond. She gre... remainder of obit for Ann Young

Garry V. Hosford

Garry V. Hosford

St. Johnsbury, VT - Garry V. Hosford, 66, died on Sunday, April 28, 2024, at the St. Johnsbury Health and Rehab Center. He was born in Windsor, Vermont on December 29, 1957, the third child of Lawrence and Harriett (Manning) Hosford and... remainder of obit for Garry V. Hosford

Michael D. Skinner

Michael D. Skinner

Lebanon, NH - Michael D. Skinner, of Lebanon, NH and Tenant's Harbor, ME, passed away peacefully on April 27, 2024, surrounded by loved ones. Mike was many things to many people, but most importantly he was a loving husband, devoted fat... remainder of obit for Michael D. Skinner

Oxbow softball at dynastic, dominant best

Oxbow softball at dynastic, dominant best

Local Roundup: Hanover, Lebanon girls tennis teams are undefeated

Local Roundup: Hanover, Lebanon girls tennis teams are undefeated

Dartmouth graduate student-workers go on strike

Dartmouth graduate student-workers go on strike

On the trail: NH Democrats quietly hold second presidential primary

On the trail: NH Democrats quietly hold second presidential primary

Search underway for hiker in NH last seen two weeks ago

Search underway for hiker in NH last seen two weeks ago

Out & About: Newport art center’s exhibition celebrates homes of all varieties

Out & About: Newport art center’s exhibition celebrates homes of all varieties