A shopping spree for Lebanon shopping centers yields mixed results for seller

| Published: 04-28-2022 10:43 PM |

WEST LEBANON — A Boston commercial real estate company that acquired three shopping plazas four years ago has sold them off to different buyers, underscoring the ongoing demand for commercial real estate in the Upper Valley.

The Davis Cos. purchased TJ Maxx (formerly Kmart) Plaza and North Country Plaza in West Lebanon and the western half of Miracle Mile Plaza from Dead River Co. for $27.15 million in 2017. The three plazas were sold in separate transactions for a total of $38 million, according to city of Lebanon assessor records.

But while Davis Cos. sold the TJ Maxx Plaza for nearly double what it paid four years ago, North Country Plaza and Miracle Mile Plaza fetched less than their 2017 sales prices. Davis Cos. invested heavily to upgrade the former Kmart Plaza to welcome Target and Sierra, while the other two plazas have struggled with vacancies and smaller commercial tenants.

“Our primary focus was on the Kmart Plaza. We saw an opportunity there to transform the property into a more contemporary mix of tenants,” said Jonathan Davis, founder and chief executive of The Davis Cos.

The firm spent millions renovating the former Kmart space, mitigating its location in the flood plain and recruiting Target and outdoor apparel retailer Sierra, both of which opened last fall. Davis paid $16.5 million for the shopping plaza, which includes retailers such as TJ Maxx and Joann Fabrics and Crafts, and sold it for $30.6 million, according to city real estate records.

Davis described the strategy of the investment fund used to purchase the plazas as “identifying opportunity, ad value and exit.”

The new owners of TJ Maxx Plaza are Chula Vista, Calif.-based USA Properties Inc. and San Diego-based Strata Equity Group, two commercial real estate investors jointly making their first foray into New Hampshire.

Michel Kucinski, chief executive of USA Properties, said he and Strata Equity Group were attracted to the property because of its stable roster of retail stores with Target serving as the anchor tenant. He said they are currently in negotiations to lease out the sole vacancy at the south end of the plaza to a restaurant or retailer.

Article continues after...

Yesterday's Most Read Articles

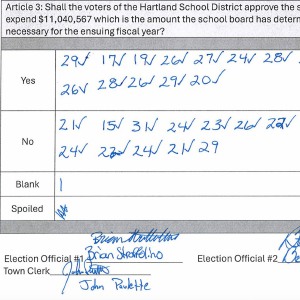

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

“We plan to keep the plaza for a long, long time,” said Kucinski, noting that he expected to make other acquisitions in the New England market as they expand beyond their California base.

Meanwhile, Hanover investor Robert Hawthorne headed a group of investors that purchased North Country Plaza on Route 12A in West Lebanon and the western portion of Miracle Mile Plaza (the east side of the plaza that includes movie theater Entertainment Cinemas and supermarket Price Chopper, is owned by Massachusetts-based The Richmond Co.).

“We liked that these are local properties with a great mix of tenants and good visibility that provide good value to Upper Valley residents,” Hawthorne said.

Hawthorne’s group paid $4.55 million for Miracle Mile Plaza, which Davis Cos. acquired for $5 million 2017 and $2.9 million for North Country Plaza, which Davis Cos. acquired for $5.65 million in 2017, according to city records.

The North Country Plaza, whose tenants include Panera, a Verizon retailer, a nail salon and auto club AAA, has had empty storefronts for several years, depressing its value. Miracle Mile Plaza, however, has fared better with tenants including urgent care clinic ClearChoiceMD, apparel store Hubert’s and Gusanoz restaurant.

As is often the case in real estate, location is key in determining investment potential, Hawthorne noted.

“These plazas are unique,” Hawthorne said. “They are at the cornerstone of interstates 89 and 91, near Dartmouth and the medical hospital and great business infrastructure like Hypertherm and Centerra business park. From both a commercial and residential perspective, they are very attractive.”

The sale of the Davis Cos. plazas follows several other significant commercial real estate deals in Lebanon in recent months.

In December, 10 Water St., also known as the Whitman Communications building, sold for $6.375 million, and the former Kleen Laundry plant at 1 Foundry St. sold for $1.1 million; in February, the Powerhouse Mall in West Lebanon was sold to Hanover-based Connecticut River Capital for $11.75 million; and in March the Valley Newssold its office building and warehouse space on Interchange Drive in West Lebanon to specialty tool company LockNLube for $2.425 million (the Valley News will remain as a tenant).

Contact John Lippman at jlippman@vnews.com.

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’

Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’ Lawsuit accuses Norwich University, former president of creating hostile environment, sex-based discrimination

Lawsuit accuses Norwich University, former president of creating hostile environment, sex-based discrimination