Commentary: The giving puzzle; Encouraging donations to nonprofits

| Published: 03-02-2023 9:28 AM |

The Children’s Literacy Foundation strives to inspire a love of reading and writing among underserved children in New Hampshire and Vermont.

Last year, CLiF raised more money from individual donors than at any time in its 25-year history — yet saw a slight decline in the actual number of donors.

Their latest fundraising results reflect the experience of most nonprofits across the U.S.

According to the Chronicle of Philanthropy, the number of donors decreased by 7% between 2021 and 2022. Digging deeper into this report, the number of donors giving $500 or less declined significantly, as did the number of new donors.

This trend can negatively impact charitable organizations, as their causes and stability become increasingly dependent on wealthy donors.

The nonprofit sector helped shape America. In 1830, the famous historian Alexis de Tocqueville marveled at the way “associations” came together in the United States to solve collective problems. He also observed how these associations — predecessors to today’s nonprofits — drew individuals out of their personal concerns and engaged them with something greater.

Commentators often point to income inequality to explain the decrease in donors. They also blame an erosion of public trust in nonprofit organizations. They overlook an important factor — that this decline was also driven by recent changes in the tax code.

The 2017 Tax Cut and Jobs Act essentially doubled the standard deduction. Gov. Phil Scott and the Vermont Legislature estimated that because of this change “less than 10% of Vermonters would be able to enjoy a tax benefit for charitable contributions.” In a special session in July 2018 the Legislature passed Act 11, which gives Vermont taxpayers a 5% tax credit on the first $20,000 of charitable contributions even if they utilize the standard deduction.

Article continues after...

Yesterday's Most Read Articles

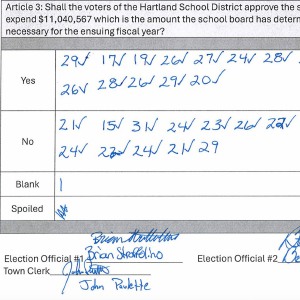

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

The federal government has not followed Vermont’s example. This year, the standard deduction will be $27,100 for married couples, meaning that the 87% of households who use the standard deduction do not get a tax break for donating to charities.

During the pandemic, Congress passed the Coronavirus Aid, Relief and Economic Security Act allowing people taking the standard deduction to also deduct a limited amount of their charitable contributions. That provision expired just two years later on Dec. 31, 2021, eliminating a key incentive for regular folks to give.

Given the crucial role nonprofits play in every social concern from child care to hunger, housing, health care and education, why are we discouraging people from getting involved?

Maybe the U.S. government cannot afford for all nonprofit donations to be tax-deductible, but shouldn’t they encourage everyone to give as Vermont does? Restoring the $300-per-individual, $600-per-family deduction and making it a permanent part of the tax code seems like a good place to start.

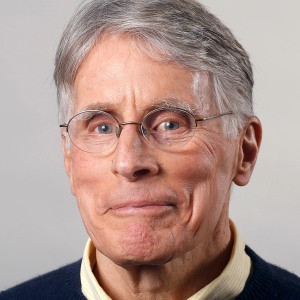

John Vogel lives in White River Junction and served on the faculty of the Tuck School of Business for 27 years, where he taught courses in real estate and nonprofit management. He currently serves on a number of nonprofit boards including the Children’s Literacy Foundation, where he is currently the treasurer, and The Vermont Community Foundation.

Editorial: Chris Sununu’s moral vacuum

Editorial: Chris Sununu’s moral vacuum Editorial: Gambling tarnishes America’s sporting life

Editorial: Gambling tarnishes America’s sporting life By the Way: A white nationalist’s many mistruths

By the Way: A white nationalist’s many mistruths Column: The age-old question of what to read

Column: The age-old question of what to read