Upper Valley businesses stung by alleged payroll tax embezzlement scheme

| Published: 04-20-2019 9:32 PM |

WEST LEBANON — Every Friday afternoon, without fail, Ryan Wall would pull up in his car at the offices of J.A.S. Auto in White River Junction to personally deliver the company’s employee paychecks.

Wall ran payroll services for TSBS, a West Lebanon tax firm doing business as AccounTax USA. TSBS, short for Twin State Business Services, had been founded by his in-laws, John and Jacqueline Rezzonico, in 1997 and is now run by their daughter Vanessa Wall, Ryan Wall’s ex-wife.

J.A.S. Auto was a client of Wall, who handled the auto body repair business’ weekly $20,000 payroll to make sure employees were paid the correct amount and the taxes were taken out and deposited with federal and state authorities.

Smiling, friendly, well-dressed, thick hair brushed back in a perfect part and clean-shaven, Wall would exclaim “Happy Friday!” as he handed the paychecks to office workers Sandi Jasmin and her daughter, Lisa Holmes, never forgetting to ask about their plans for the weekend and if Sandi’s husband and Lisa’s brother, J.A.S. Auto owner Toby Jasmin, would be playing golf.

“He’d call in the morning to say the checks were ready and then hand-deliver them that afternoon,” Toby Jasmin recalled by telephone from Spain, where he was on vacation last week. “He’d come in, say, ‘How ya doin’? Here’s your checks,’ chitchat for a bit, leave. He was in and out.”

If federal charges against Wall are true, it was a stunning and brazen act of deceit, Jasmin and scores of other Upper Valley business owners now realize.

Unknown to his clients at the time, Wall allegedly was skimming thousands of dollars — sometimes tens of thousands of dollars — from clients for his personal enrichment in money that was supposed to be paid in taxes to federal and state governments.

Jasmin said that by the time Wall’s alleged scheme was uncovered, his business owed the Internal Revenue Service $120,000 in unpaid taxes over an 18-month period — the equivalent of what Jasmin matches to his employees’ 401(k) retirement accounts or pays for the company’s medical insurance policy. As unexpected expenses go, it takes the cake.

Article continues after...

Yesterday's Most Read Articles

“I’ve had to paint a bumper or a fender for free a couple times,” Jasmin said. “But I’ve never taken a hit like this in business. This number is going to take a while to recover.”

Jasmin is not alone. Dozens of small, family-run businesses in the Upper Valley began to learn last fall that their federal and state taxes had not been paid by Wall’s firm, according to a federal indictment against Wall and interviews with the business owners.

Many of the owners said that the sudden shock of making restitution for the unpaid taxes — businesses still have to pay them despite Wall allegedly pocketing the original money — is forcing them to absorb losses, work weekends or hire fewer employees this summer to hold costs down.

Wall, a former Quechee resident who now resides in Tampa, Fla., is being charged with embezzling $1.2 million from TSBS clients, according to a federal indictment unsealed on April 12 in U.S. District Court in Burlington. Wall, 41, turned himself in to authorities in Florida and appeared before a federal magistrate in U.S. District Court in Tampa. He was released on a $10,000 unsecured bond on the condition that he would surrender himself to federal authorities in Vermont. He was directed to report May 16 or May 29 to U.S. District Court in Burlington.

Authorities also charged Wall with possessing three firearms — a 9 mm rifle, a 9 mm pistol and a .22-caliber rifle — while being an “unlawful user of or addicted to” oxycodone, heroin and cocaine base and, if convicted, would compel him to surrender his guns.

Wall declined to comment last week when contacted for an earlier story in the Valley News; a Facebook message seeking an interview for this story was not returned.

Some of Wall’s former clients are just coming to terms with the fallout.

“I never dreamed this would happen to me. You hear about it happening to other people,” said Daniel Henry, who has operated a West Lebanon commercial janitorial service for 52 years. Henry said he ended up owing the IRS about $7,000, including interest and penalties, for unpaid payroll taxes that allegedly were not paid by Wall.

“And I was one of the smaller ones,” said Henry, whose brother, Chick Henry, owns Upper Valley Equipment Rentals in West Lebanon and is the former owner of the Canaan Fair Speedway. “We did survive. We will survive. I only hope someday justice is served and I get this back.”

The indictment also charges Wall with a felony count of unlawfully using oxycodone, heroin and crack cocaine while possessing firearms.

Some former clients say Wall, who was severely injured in a 2008 car accident on Route 4, had visibly lost weight in recent years and sometimes appeared highly agitated.

Wall, who grew up in Barnard, was in the Woodstock Union High School Class of 1995 and graduated from Johnson State College (now Northern Vermont University) in 2000 with a degree in business management. He had worked as a territory manager for Pfizer, according to his social media profiles. A Valley News business story in January 2011 reported that he and wife Vanessa had joined Twin State Business Services, where she was to work as an AccounTax USA tax consultant.

Within a year, the Rezzonicos decided to form a payroll services division. Wall ran that side of the business until late 2018, when he was fired after it was discovered that “for many years (he) had been embezzling customer funds deposited with (TSBS) to pay withholding and other payroll taxes,” according the bankruptcy proceeding of TSBS, which filed for bankruptcy protection in January.

Wall began embezzling clients’ money not long after he went to work for his in-laws, according to the federal indictment against him. Beginning no later than 2012, the indictment outlined, Wall issued checks to himself drawn upon a payroll escrow account at Mascoma Bank that contained clients’ money. In addition, Wall issued “hundreds” of checks to third parties, who cashed the checks and gave the money back to Wall or used it to purchase drugs that were given to Wall, according to the indictment.

Described by former clients as “gregarious,” “personable” and “outgoing,” Wall built up a client base of well-known Upper Valley restaurants, contractors, hair salons, and retail stores, as well as a dentist and veterinarian, according to a list of payroll tax creditors listed in the TSBS bankruptcy proceeding.

Many of Wall’s clients were from West Lebanon, White River Junction, Woodstock and Quechee. A number came through connections he made at the Quechee Club, where he liked to play golf with clients and friends, former clients said.

“I played golf and socialized with him,” recalled Jasmin, a member of the club. “He said, ‘Let me do your payroll,’ and I was thinking he’s local and I like to support local businesses ... the reason I liked him was because if someone needed an advancement in pay for vacation or something, he was just a phone call away.”

Toby Jasmin’s sister Lisa Holmes and her husband, Todd Holmes, who owns Valley Turf Services in White River Junction, hired Wall to handle payroll for Holmes’ business, which builds and maintains athletic fields for area schools. They also had exchanged invitations to each other’s homes for dinner.

Todd Holmes said he learned that something was amiss when he started getting notices last year from the IRS asking him why his payroll taxes hadn’t been paid. Perplexed, Holmes said he called the 800 number for the IRS and was told they hadn’t received any deposits from his business since 2014.

“I’m out about $40,000 to the federal government, and I haven’t even dealt with the state yet,” he said. “We’ve already paid it once. Now we pay it again. So it’s not $40,000. It’s $80,000.”

Holmes is just coming up on his busy season when he usually hires a six- to seven-person work crew for the summer.

“The plan is to keep it half that number this summer,” Holmes said. “I’ve got to make it up somewhere.”

For most of Wall’s clients, the first inkling that something was wrong with their payroll taxes came when they got notices from the IRS that their taxes had never been received.

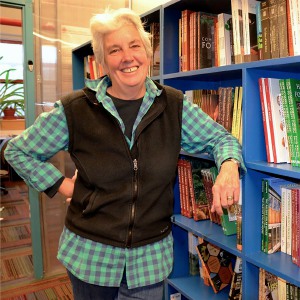

Ruth Schimmelpfennig, the former owner of Ruth’s Table restaurant in Woodstock, said she hired Wall when she opened her business in 2015 because “he came recommended as very savvy and had had a lot of experience with handling out-of-house bookkeeping for restaurants.”

“I contacted him,” she said. “He was very friendly, upbeat and positive, and that’s what I needed at the time.”

But after returning from a trip to California last year, she “walked right into a pile of letters from the IRS” demanding to know why she hadn’t sent in any withholding taxes since 2015.

“I was beside myself,” Schimmelpfennig said. When she called Wall to ask what happened, he waved her off, assuring his client that the problem was with the IRS.

“The IRS always makes mistakes,” Schimmelpfennig recalled Wall telling her on the phone. “They really like to bully small businesses. Don’t lose sleep on it,” he told her, before she said he signed off with words she will never forget: “I got your back.”

The crisis with the IRS came just as Schimmelpfennig was selling her restaurant to Bentleys co-owner Maria Freddura, a veteran Boston restaurant operator who volunteered to help Schimmelpfennig negotiate with the IRS and minimize her losses.

Schimmelpfennig, who declined to say how much she lost other than it was “in the thousands,” called what Wall is alleged to have done “unforgivable.”

“He violated a sacred trust with small businesses where you are working very hard to pay your bills,” she said.

Freddura said she’d encountered a similar financial problem with a former employee of Bentleys and knew how to deconstruct the financial records to uncover the scheme.

“We spent a week going through all of Ruth’s payroll records and bank statements, and I managed to get to the bottom of it and helped her recover money,” Freddura said. “Ruth was the lucky one.”

Scott Bacon said he was a Wall victim from two of his businesses: a painting business and as a co-owner of The Public House Diner in Quechee Gorge Village.

“I’d seen (Wall) kicking around Quechee for years. He’s a social butterfly,” Bacon said. “A few people were already using him. It was word of mouth.”

So he hired Wall to handle the payroll for his Quechee painting business, The Perfect Coat, and with his partner Andrew Schain for The Public House Diner.

But Bacon said that when he began getting letters from the IRS about his payroll taxes, he texted Wall with photos of the IRS letters, asking what the problem was.

“I was always getting a notice in the mail. Then I’d call him (about why the payroll taxes hasn’t been paid) and he’d say, ‘No, no, I’ve done that. It just takes a few weeks to get into the system.’ But it continued over and over again.”

Bacon said it was not until two months ago, when he and restaurant partner Schain were each interviewed by an FBI agent, that he definitively learned Wall was being investigated for embezzlement.

But as early as January, Bacon said, rumors began circulating that he and Schain weren’t the only ones having problems with Wall. Bacon recounted running into his friend Todd Holmes at a pizza shop in Quechee.

“Todd came right up to me and said, ‘There’s stuff going down. You’d better get on top of this.’ ”

In the end, Bacon said, he owed $5,000 in unpaid payroll taxes on his painting business and he and Schain owed $13,000 for unpaid taxes on the restaurant.

“He got me twice,” Bacon said of Wall, likening the total of $18,000 to the equivalent of “three house painting jobs.”

At the restaurant alone, Schain said, $13,000 can amount to a month’s worth of profits during the slow winter season.

“We found out in October, just at the end of the season,” Schain said.

Left to pick up the pieces is Vanessa Wall, Ryan Wall’s ex-wife, who former clients said has been working conscientiously with them to resolve the unpaid payroll taxes and assisting them in finding a new payroll services company.

Vanessa Wall, who declined comment on Thursday, filed for personal bankruptcy in November but is petitioning the bankruptcy court to acquire the assets of TSBS.

In a motion to the court in March, the trustee for TSBS is seeking permission to sell her the tax preparation side of the business, which generated about $220,000 in recent years. Vanessa Wall’s parents “had always intended to pass (TSBS) on to their daughter ... who worked for several years as an employee at (TSBS) preparing tax returns” and became a manager of the company, the motion said.

Using the name Upper Valley Tax Preparation LLC, Vanessa Wall is now offering to buy TSBS’ tax preparation business for $32,000. She has made a down payment of $15,000 toward the purchase and the “source for the cash to pay the purchase price will be a combination of a loan she has or will receive from her aunt and uncle and personal funds,” the motion said.

John Lippman can be reached at jlippman@vnews.com.

Zantop daughter: ‘I wish James' family the best and hope that they are able to heal’

Zantop daughter: ‘I wish James' family the best and hope that they are able to heal’ Chelsea Green to be sold to international publishing behemoth

Chelsea Green to be sold to international publishing behemoth