Auditor says Norwich town finances are back in order

| Published: 03-26-2023 1:39 AM |

NORWICH — During a discussion about problems uncovered in the town’s most recent audit, officials received recommendations and encouraging news about the town’s finances from an independent auditor last week.

The Selectboard met on Wednesday with Richard Brigham, an auditor with the Montpelier accounting firm Sullivan and Powers & Co., which conducted the 2022 audit that found the town’s accounting in disarray. He gave a reassuring report regarding the current state of finances. Since the audit, all funds have been deposited in their proper accounts and balances have been reconciled, Brigham said. Now, the town should focus on preparing for the next audit. (Fiscal year 2023 ends on June 30.)

“I totally think that 2023’s audit is going to have a much better result in terms of the findings,” Brigham said. “I looked at the (town’s) responses that were given to us, (and) I think if the town ensures they are carrying out those responses, that all those findings will disappear in the new year.”

The town ended fiscal year 2022 with a budget surplus of $379,834, which was added to a fund balance that now totals $1.79 million.

Brigham also told the Selectboard that a disclaimer opinion issued with its 2022 audit should not prevent Norwich from borrowing money.

“I’ve not seen that (problem) with municipalities in the past,” Brigham said. “I obviously cannot speak for bankers, but I’d be very surprised if you had any issue with a bond bank or anything like that. But even if you did, by that time, you might have a 2023 audit that you have an opinion for.”

The 2022 audit report, released last month, identified a list of material and significant deficiencies in the town’s financial management during the last fiscal year, July 1, 2021 to July 30, 2022.

A lack of internal controls, auditors found, resulted in accounting errors that were still unresolved at the end of the fiscal year and required financial experts to make “various adjustments” to correct the balances.

Article continues after...

Yesterday's Most Read Articles

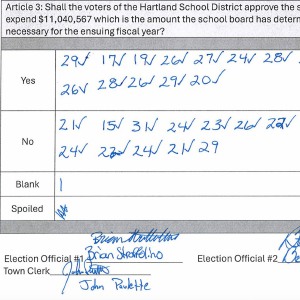

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

In addition, Norwich’s lack of a permanent finance official to verify the records submitted for audit — in the form of a signed letter of representation — necessitated the auditors to issue “a disclaimer of opinion,” which meant the auditors lacked sufficient evidence to render an opinion about the town’s financial statement.

“With the transition in the (town) manager’s office and the finance team throughout the year, this was not an easy audit to perform,” Brigham noted.

In a summarized plan to correct these deficiencies, Norwich officials said they intend to review accounts monthly and reconcile discrepancies in a timely manner.

Brigham also recommended developing clear policies and defined roles to ensure town staff and elected officials communicate effectively.

“Communication is an issue there, and some of it is just people not knowing what or where things have to go in a timely fashion,” Brigham said. “So I think if we can get that written down and clearly establish a line of communication from all channels — board, treasurer, finance director and manager — I really don’t think we are going to have any more communication problems.”

In a report this month, Joyce Hasbrouck, Norwich’s interim finance director, was critical of the town’s processes, saying the sharing of financial documentation between the elected town treasurer and the finance director is “slow at best and is often lacking altogether.”

“The finance department is then forced to either process transactions late or without backup or not post the transactions,” Hasbrouck stated. “All these options result in a failure to properly state the finances in a timely manner and make reconciliations impossible.”

Former town Finance Director Fielding Essensa made similar claims to the Valley News in an email on March 7. Essensa said it took Treasurer Cheryl Lindberg several weeks to grant him read-only access to the online bank accounts.

“In addition, nearly all outside financial communications surrounding town finances are directed to her, and in almost all cases do not make it to the Finance Office, making a system of internal controls (or) any sort of month end close or reconciliation of accounts impossible,” Essensa wrote.

Essensa said there was no discussion between Hasbrouck and himself about the audit findings or Hasbrouck’s report in an email on Thursday.

Hasbrouck did not return an email from the Valley News seeking comment.

Lindberg disputed both Essensa’s and Hasbrouck’s claims.

“The former finance director had access to the banking information online that I provided shortly after he arrived,” Lindberg said in a phone interview. “He needed that information to do his duties, and I provided that as soon as possible.”

Lindberg, the elected town treasurer of 27 years, noted that accounting was not an issue under former longtime Finance Director Roberta Robertson, whose employment in Norwich coincided with much of Lindberg’s service.

Since Robertson’s retirement in 2019, Norwich has struggled to find and retain qualified and consistent leadership in its finance department. Robertson’s successor, Donna Flies, left the job after she made multiple unauthorized payments in connection with an email scam, resulting in a loss of nearly $250,000 in municipal funds. Following Flies’ departure, Norwich went over two years without a permanent finance director until Essensa’s hire.

“The focus should be on the deficiencies pointed out by the auditor, and under Vermont statute and the town those deficiencies are in the control of the town manager and the finance director,” Lindberg said.

Norwich’s lack of a permanent finance director could result in another disclaimer opinion for its fiscal year 2023 audit, Brigham noted.

Hasbrouck, a contracted employee of Robert Half Financing and Accounting, a national staffing firm, was not permitted by her employers to sign the letter of representation for the 2022 audit.

“I’ve had consultants who have had to come run finance departments, but I’ve never had a situation where they wouldn’t sign the representation letter,” Brigham said.

Had there been a signed letter of representation, Brigham said his firm “probably would have been able to give (Norwich) a qualified opinion,” which means the auditors would have found the financial statement to be fairly presented except for the specified deficiencies.

Patrick Adrian may be reached at padrian@vnews.com and (603)727-3216.

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’

Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’ Lawsuit accuses Norwich University, former president of creating hostile environment, sex-based discrimination

Lawsuit accuses Norwich University, former president of creating hostile environment, sex-based discrimination