Lebanon homeowners getting the worst of shift in property tax burden as valuations soar

| Published: 11-05-2022 10:29 PM |

LEBANON — City officials are preparing residents for the prospect of significantly higher property tax bills in November due to the surge in residential home values versus nonresidential properties during the last year.

Single-family homes in the city increased in assessed value by an average of 27% since April 2021.

And commercial apartment buildings — defined as apartment buildings containing four or more units — increased by an average value of 55%, according to a recently completed citywide revaluation.

“This is the highest climb I have ever seen, and I’ve been doing this for 35 years now,” said Steve Whalen, of Vision Government Solutions, a Massachusetts-based firm that conducted the revaluation. “But all over New England we are seeing these kinds of changes.”

Broad changes in home values do not typically correspond to a notable change in a property’s tax bills, since higher overall property values also increase a city’s or town’s total valuation, which can result in a reduction of the local tax rate.

But Lebanon’s high concentration of commercial and industrial properties, which have comprised about 40% of the city’s taxable value, have created an unusual situation. In contrast to the housing market, commercial and industrial properties has seen increases in value of 8% to 11% on average.

In other words, the lion’s share of Lebanon’s change in total valuation, which increased by 20%, or over $450 million since 2021, is derived primarily from residential home prices.

This rate of residential property growth was so high that it has shifted 4% of the local property tax burden from commercial and industrial properties to homeowners and renters. Residential properties, which had a 55% share of the tax burden from 2017 to 2021, will now have just short of 60% of the share. Commercial and industrial properties will now comprise 36% of the tax share, and utilities will have about 4%.

Article continues after...

Yesterday's Most Read Articles

Upper Valley winter shelters kept dozens warm and dry

Upper Valley winter shelters kept dozens warm and dry

Former principal of South Royalton School released from prison

Former principal of South Royalton School released from prison

Owner of Friesian horse facility ordered to pay care costs for seized animals

Owner of Friesian horse facility ordered to pay care costs for seized animals

“It’s not an issue of increased (city) spending but an issue of a shift in who pays the burden, because of the white-hot market for residential properties,” explained City Manager Shaun Mulholland. “It’s something we really haven’t seen before.”

The tax impacts from this revaluation will differ for each homeowner, since each property is assessed on a number of factors, from a house’s age or condition, the property size, the neighborhood, amenities such as a garage or swimming pool and the type of architecture, Mulholland said.

Appraisers primarily base their valuations of residential properties on housing sales and market demand, including home sale prices. This process also determines which types of housing or style of homes have the highest market demand.

In Lebanon, colonial-style homes had an average increase of 36% in value. Ranch-style homes increased by an average of 29%, and Cape Cod houses increased on average by 24%. Mobile homes increased on average by 18%.

For commercial properties, appraisers typically use “an income approach” to determine value rather than sales figures, given the less frequent sales turnover of these properties, Whalen said. The income approach examines property-related income and expenses, including rents and vacancies, as well as land value, building cost and depreciation.

“Typically the commercial properties don’t tend to increase at the same rate because they are often locked into multiple-year leases,” Whalen explained. “They do go up but not at the same rate that the housing market is currently going up.”

Whalen added that many commercial property sales “took it pretty hard” during the pandemic, particularly restaurants, retail spaces and hotels. Many leased commercial properties had a number of vacancies or had tenants who moved out or stopped paying rent.

Lebanon officials anticipate the city tax rate to decrease as a result of the city’s substantial increase in total valuation. The city is still waiting for the New Hampshire Department of Revenue Administration to finalize the new tax rate, but Mulholland said he expects an estimated decrease from the current rate of $10.06 per $1,000 to a 2022 rate of $8.62 per $1,000 of assessed value.

But even with this reduction, many homeowners and renters will see hikes in their property taxes, including some with substantial increases, Mulholland warned.

To illustrate these impacts, a house that increased in value by 36% from $238,800 in 2021 to $325,000 would see an increase of $399 in their city tax portion under the new anticipated tax rate. A house that increased from $442,900 to $593,800, a 36% increase, would see a $633 increase in their annual city taxes.

In contrast, a commercial property that increased by only 11% in value, from $322,700 to $357,500 would have a tax cut of $165 in its city tax portion.

City councilors, at a meeting last week, also noted that these figures do not include school and county taxes, which make up the majority of a property owner’s tax bill.

The current school district portion of the tax rate is $13.20, while the Grafton County rate is $1.70, for total rate of just under $27 per $1,000 of assessed value.

Councilor Karen Liot-Hill said it was important to warn residents about the total potential impact, even if the city does not know yet what the new tax rate of the school district will be.

“If it’s a bad story and there’s nothing we can do about it, then we can at least give people notice so they can manage their own budgets the best they can,” Liot-Hill said.

Mulholland said the city hopes to send out its new tax bills within the next two weeks, depending on when the state, which is behind schedule this year, finalizes the reevaluated tax rate.

Mulholland also plans to send a letter to city residents next week to inform them about what to expect. The letter will also direct residents to informational pages on the city website, including a slide presentation narrated by Mulholland that explains the potential tax implications of the new revaluation.

Some information may currently be found on the city website at https://lebanonnh.gov/1651/2022-Lebanon-Property-Revaluation.

The intent of revaluations, which the state requires every five years, is to ensure that properties are taxed equally based on their current market value. In addition, valuations are key to determining a tax rate for municipal, school and county services, as tax rates are based on both budget impacts and the total valuation of a town’s or city’s taxable properties.

Patrick Adrian may be reached at 603-727-3216 or at padrian@vnews.com.

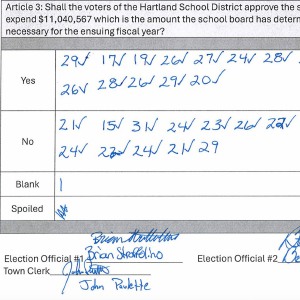

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote