Site of anti-tax standoff in Plainfield back on market after major renovation

| Published: 06-29-2021 9:40 PM |

PLAINFIELD — The former home of Plainfield tax evaders Ed and Elaine Brown is on the market for $1.59 million after a two-year renovation at the 100-acre compound on Center of Town Road.

The turreted 7,500-square-foot home where the Browns waged a nine-month anti-tax standoff with U.S. Marshals in 2007 is now adorned with new windows, a redesigned kitchen and hardwood floors throughout.

New amenities include granite countertops, walk-in closets, a steam room, artist studio and four fireplaces, according to its listing on Four Seasons Sotheby’s International Realty website.

“This unique splendidly renovated contemporary home features a sprawling floor plan, an elegant display of design, fine craftsmanship, and placed high on the top of a Southeast facing ridge,” the listing said. It makes no mention of the standoff, which prevented Supreme Court Justice Stephen Breyer from making his annual summer visit to a neighboring home owned by the Breyer family.

The new look at the former Brown house is the result of upgrades commissioned by out-of-state owners Peter and Sharon Farnum, who purchased the property as an investment in 2019, according to Lochrane Gary, the Hanover-based Sotheby’s real estate agent listing the home.

The couple bought the property for $315,000, according to town assessing records.

“Some of the first steps that they took was essentially bringing it back up to livable conditions,” Gary said. “They did everything from the ground up.”

Construction crews pulled out old buried oil tanks, disposed of the Browns’ generator and redid the flooring, paint, bathroom and kitchen to make the property presentable, he said.

Article continues after...

Yesterday's Most Read Articles

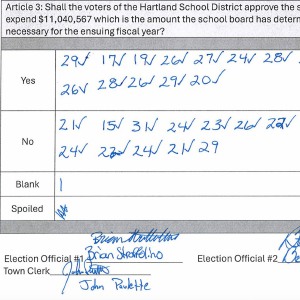

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

During the effort crews did not come across any of the explosives the Browns were feared to have used to booby-trap the property, Gary added, calling rumors of their existence “simply conjecture.”

“We’ve had a lot of interest,” the real estate agent said, attributing that to the renovation and recent uptick in Upper Valley home sales.

As of Tuesday, Gary said, three people had reached out to inquire about the home and he’d already done a showing for one.

“We’re very hopeful that a new buyer will come in and see what these sellers have reimagined the property to be,” he said.

The property is currently assessed for $697,072, according to town records. Plainfield Town Administrator Steve Halleran on Tuesday estimated property taxes would run about $17,700 a year.

“They’ve made it very nice,” Halleran said of the Farnums, adding that the building was abandoned for more than a decade after the Browns’ 2008 arrest.

The Browns were convicted in 2009 of conspiracy to prevent government agents from discharging their duties, obstruction of justice, and illegal possession of firearms, among other charges.

Elaine Brown, who had a dental practice in West Lebanon, eventually apologized for her actions and was released from federal prison last year after one charge against her was vacated. That charge, which involved the Browns’ use of explosives and carried a minimum mandatory sentence, was reversed by a U.S. Supreme Court decision that found it was invalid.

Ed Brown also sought to be released early and was rebuffed last year. He’s expected to serve another 16 years.

At the time, U.S. District Court Judge George Singal said Ed Brown hadn’t shown remorse like his wife and some of the family’s followers.

“They learned that what they had done was wrong; they learned that what they had done was a mistake,” Singal said of the community that flocked to the Browns. “I don’t see that in Mr. Brown.”

Meanwhile, town officials say their efforts to collect back taxes on the property failed.

A federal judge in 2017 ordered that Plainfield receive $36,334 from the sale of the compound at auction two years earlier from the federal government, which had seized the property.

Plainfield resident James Hollander purchased the property for $205,000, but the federal government laid claim to most of the proceeds, saying it was owed for maintaining the site since 2008.

The town argued it was owed $232,661 in unpaid property taxes and other local assessments.

“They recovered their monies first,” Halleran, Plainfield’s town administrator, said of the federal government. “By the time it got to our taxes, there was no money left.”

Halleran went on to say that the town “wrote that money off years ago” and doesn’t intend to contest the matter further. “The federal government took over ownership and they trump us all,” he said.

Tim Camerato can be reached at tcamerato@vnews.com or 603-727-3223.

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom

At Dartmouth, hundreds protest ongoing war in Gaza and express support for academic freedom Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’

Over Easy: ‘A breakfast without a newspaper is a horse without a saddle’