Editorial: Disregard for donor intent won’t pay off

| Published: 04-24-2023 9:34 AM |

Why would a prestigious institution endowed with an embarrassment of riches risk embarrassment by trying to get just a little richer? And, can donors to New Hampshire nonprofits be assured that their charitable gifts will be used as intended?

These related questions are prompted by a New Hampshire Bulletin story that appeared in last Tuesday’s Valley News. It chronicled an unseemly legal wrangle between Dartmouth and the estate of Robert T. Keeler, a prominent Ohio lawyer who graduated from Dartmouth in 1936 and had a home in Dorset, Vt. He died in 2002 at age 88, making a bequest to the college for the sole purpose of upgrading and maintaining the Hanover Country Club golf course. His will also stipulated that any proceeds in excess of the amount needed for that purpose would revert to the Robert T. Keeler Foundation, an Ohio nonprofit that supports children in need.

The college permanently closed the golf course in 2020 on the grounds that it represented an unsustainable financial drain. Nonetheless, Dartmouth is trying to hang on to the Keeler gift, now worth $3.8 million. It wants to use the money (which amounts to little more than a rounding error on the college’s $8 billion endowment) for “golf-related purposes” such as the study and design of golf practice areas that support the college’s golf teams.

To effect this change, the college filed an application in 2021 with the 2nd Circuit Court’s Probate Division in North Haverhill to modify the terms of the bequest. The modification was granted by the court in 2022 with the assent of the state Attorney General’s Charitable Trusts Unit, which is by law assigned to protect the interests of donors. The court earlier denied a motion by the Keeler estate and foundation to participate in the proceedings.

The case is now pending before the New Hampshire Supreme Court, which heard arguments recently in an appeal by the Keeler estate and Keeler foundation, which are seeking to have the ruling that granted the modification vacated and the case sent back to the Probate court. And the Keeler interests want to be allowed to intervene in the proceedings this time.

They argue, among other things, that the modification defeats the original purpose of the gift and is therefore fatally flawed; that the Probate court failed to investigate and establish the factual basis that is required by law for the modification; and that the Charitable Trusts Unit’s stamp of approval was of the rubber variety.

Dartmouth, for its part, contends that the estate and foundation lack legal standing to intervene; and that the statement of understanding between the Keeler estate and Dartmouth that formalized the gift made no provision for the estate or the foundation to recover the money if the golf course was closed.

You are not alone if this begins to remind you of Jarndyce v. Jarndyce, the notoriously interminable lawsuit depicted in the great Dickens novel “Bleak House.” These are the kinds of legal knots Supreme Court justices get paid to untangle; editorial writers do not. But there are elements for which comment does not depend on grasp of legal niceties.

Article continues after...

Yesterday's Most Read Articles

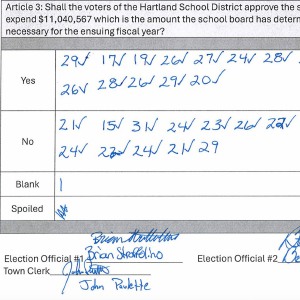

Hartland voters successfully petition for school budget revote

Hartland voters successfully petition for school budget revote

JAG Productions announces closure, citing ‘crisis facing the arts’

JAG Productions announces closure, citing ‘crisis facing the arts’

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

Hanover’s Perreard may soon capture the attention of collegiate coaches in two athletic pursuits

One is that many people suspected at the time that the underlying motivation for closing the golf course was to use the land to expand the footprint of the college’s facilities; indeed, Dartmouth now plans to build student housing on part of the property. The disclosure that $3.8 million was available to subsidize the course’s continued operation lends further credence to those suspicions.

It is certainly the college’s right and duty to use the property to further what it deems to be its best interests. Nor do we hold that living institutions must forever be governed by the dead hand of donations. Circumstances change; sometimes modifications of bequests are the only way to continue to honor the donor’s intent.

But in this case, Dartmouth altered the circumstances of its own volition by closing the course, and at the time the gift was made the donor’s estate specifically declined to allow the money to be used for more general purposes if it could no longer be applied to the golf course.

The attempt to overturn Keeler’s wishes is bound to give pause to potential future donors to the college and to other New Hampshire nonprofits who may well wonder whether their charitable intention will be faithfully observed or breached if it becomes convenient to do so.

The simple, honorable and smart thing to do here is to give back the money graciously, no legal questions asked.

Editorial: Parker parole a reminder of how violence reshapes our lives

Editorial: Parker parole a reminder of how violence reshapes our lives Editorial: Chris Sununu’s moral vacuum

Editorial: Chris Sununu’s moral vacuum Editorial: Gambling tarnishes America’s sporting life

Editorial: Gambling tarnishes America’s sporting life By the Way: A white nationalist’s many mistruths

By the Way: A white nationalist’s many mistruths