Zantop daughter: ‘I wish James' family the best and hope that they are able to heal’

HANOVER — One of Susanne and Half Zantop’s two daughters said Thursday that she tries to “compartmentalize” her personal grief over the loss of her parents from her attitude about the fate of James Parker, who was paroled on Thursday after serving the...

James Parker granted parole for his role in Dartmouth professors’ stabbing deaths

CONCORD — A man who has served more than half of his life in prison for his role in the 2001 stabbing deaths of two married Dartmouth College professors as part of a plan to rob and kill people before fleeing overseas was granted parole Thursday.James...

Most Read

Kenyon: Dartmouth alumni join union-busting effort

Kenyon: Dartmouth alumni join union-busting effort

Hartford voters approve school budget and building repair bond

Hartford voters approve school budget and building repair bond

Starbucks store planned for Route 120 at Centerra

Starbucks store planned for Route 120 at Centerra

Local Roundup: Hanover pitcher throws a perfect game

Local Roundup: Hanover pitcher throws a perfect game

Parker up for parole more than 2 decades after Dartmouth professor stabbing deaths

Parker up for parole more than 2 decades after Dartmouth professor stabbing deaths

Editors Picks

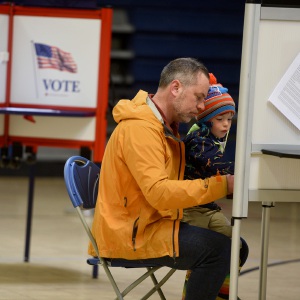

Town Meeting 2024: Previews and results of Upper Valley meetings and votes

Town Meeting 2024: Previews and results of Upper Valley meetings and votes

A Life: Priscilla Sears ‘was bold enough to be very demanding’

A Life: Priscilla Sears ‘was bold enough to be very demanding’

Kenyon: Dismas House celebrates 10 years of fresh starts in Hartford

Kenyon: Dismas House celebrates 10 years of fresh starts in Hartford

Editorial: Accounting can now begin in Claremont police case

Editorial: Accounting can now begin in Claremont police case

Sports

2024 Upper Valley high school track and field guide

As surely as snapping the finish-line tape signifies a winner, the Upper Valley is filled with high school track and field potential this spring.A number of area schools won outdoor titles last year, and some followed that up with indoor successes...

Thetford tops Windsor in 19-18 softball slugfest

Thetford tops Windsor in 19-18 softball slugfest

2024 HS boys lacrosse guide

2024 HS boys lacrosse guide

Kenyon: Dartmouth alumni join union-busting effort

Kenyon: Dartmouth alumni join union-busting effort

Windsor baseball’s annual gauntlet begins with Hartford defeat

Windsor baseball’s annual gauntlet begins with Hartford defeat

Opinion

A Yankee Notebook: An inevitable and terminal move

Living three and a half hours apart, as we do, my dear friend Bea and I get to see each other about every two weeks or so, on average. This is almost without doubt an ideal arrangement, as our lifestyles are quite different, and neither of us could...

Editorial: Gambling tarnishes America’s sporting life

Editorial: Gambling tarnishes America’s sporting life

By the Way: A white nationalist’s many mistruths

By the Way: A white nationalist’s many mistruths

Column: The age-old question of what to read

Column: The age-old question of what to read

Editorial: Transparency wins in NH Supreme Court ruling

Editorial: Transparency wins in NH Supreme Court ruling

Photos

Acoustic music jam in White River Junction

Stocking Windsor’s Kennedy Pond

Stocking Windsor’s Kennedy Pond

Quechee Gorge Bridge construction begins

Quechee Gorge Bridge construction begins

Getting a lift in South Royalton

Getting a lift in South Royalton

Lebanon’s reconstruction project

Lebanon’s reconstruction project

Arts & Life

Art Notes: After losing primary venues, JAG Productions persists

For much of its history, JAG Productions, the small, White River Junction theater company that specializes in telling stories from deep inside the black, queer, American experience, has had to be nimble. Company founder Jarvis Antonio Green has...

Over Easy: Marvels in the heavens, and in the yard

Over Easy: Marvels in the heavens, and in the yard

Art Notes: The Pilgrims to perform ‘last’ show Saturday in Hanover

Art Notes: The Pilgrims to perform ‘last’ show Saturday in Hanover

Upper Valley residents witness total eclipse

Upper Valley residents witness total eclipse

Obituaries

Lisa Gurney

Lisa Gurney

Newbury, VT - Lisa Marie Gurney, age 55, passed Thursday, March 7, 2024. There will be a graveside service on Thursday, May 2, 2024, at the New Oxbow Cemetery in Newbury, VT, at 10 AM. ... remainder of obit for Lisa Gurney

Megan Mattern

Megan Mattern

Midland, TX - Megan Mattern, 44, passed away on March 15, 2024, at Dartmouth Hitchcock Medical Center, after a valiant fight with cancer. Born December 6, 1979 to Wes and Susan Mattern, Meg... remainder of obit for Megan Mattern

James R. Thibodeau

James R. Thibodeau

Leland, NC - James R. Thibodeau, age 75, passed Saturday, April 13, 2024. A full obituary will be published in an upcoming edition of the Valley News. Ricker Funeral Home has assist... remainder of obit for James R. Thibodeau

Beverly Vaughan

Beverly Vaughan

East Thetford, VT - Beverly Vaughan, 76, of East Thetford, VT, died unexpectedly on Sunday, April 14, 2024. She was born on December 18,1947, to Floyd and Bessie (Minor) Dexter. She gre... remainder of obit for Beverly Vaughan

2024 Upper Valley high school girls lacrosse guide

2024 Upper Valley high school girls lacrosse guide

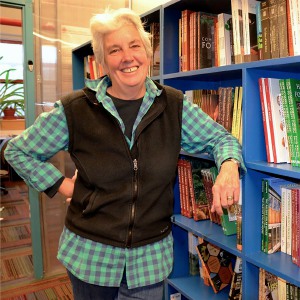

Chelsea Green to be sold to international publishing behemoth

Chelsea Green to be sold to international publishing behemoth

Football helmet maker buys Lebanon’s Simbex

Football helmet maker buys Lebanon’s Simbex

Amid financial difficulties, Lebanon-based Revels North cancels midwinter show

Amid financial difficulties, Lebanon-based Revels North cancels midwinter show